By Lucas James | March 17, 2025

Solana achieved a significant breakthrough by letting its futures contracts enter Chicago Mercantile Exchange (CME) trading. Solana achieves a major milestone that benefits the entire crypto marketplace by advancing the potential development of Solana-based ETFs.

The blockchain project Solana celebrates its fifth market anniversary while holding the position as the sixth-greatest blockchain network based on market capitalization. The availability of futures trading through CME positions Solana closer to mainstream financial products, bringing more investors into the market.

What Are Solana Futures and Why Should You Care?

CME has issued two different futures trading contracts that deal with Solana (SOL). The contracts interrupt Solana futures trading at two different size points, supporting tracking 25 SOL and 500 SOL. The trading contracts enable users to protect their positions or predict price changes of the Solana token SOL. Americans who want better options than volatile crypto markets for controlling cryptocurrency price risk now have a response from CME Group as traders seek structured and safer financial products for trading cryptocurrencies.

Giovanni Vicioso from CME Group clarified that these new futures contracts will act as a capital-efficient solution for both investment and hedging because Solana maintains its position as the platform selection for developers and investors.

Solana’s Path to an ETF

Exchange-traded funds (ETFs) linked to Solana currently represent one of the most discussed points in its investor community. Futures trading provides a major advancement toward the achievement of this goal. The new development by Solana-based platform Titan suggests that SOL ETFs might gain approval according to founder Chris Chung. Solana on X.

According to Matthew Sigel, who serves as VanEck’s Head of Digital Assets Research, the establishment of futures trading creates significant progress in Solana ETF authorization. As Solana matures in the market, it will soon get approved for mainstream financial products, including ETFs, which initially seemed improbable.

Regulatory Landscape and SEC Approval

Noteworthy regulatory clearance remains the major impediment to this development. A minimum of 13 Solana-based exchange-traded funds (ETFs) seek U.S. Securities and Exchange Commission (SEC) authorization for approval at present. Spot Bitcoin ETFs and Ethereum ETFs have obtained approval recently, which has generated increased market interest in Solana.

Security or not is currently the decisive question for how the SEC will treat the Solana asset. The SEC classification of Solana will shape the timeline necessary for accepting Solana ETFs. Solana and XRP ETF applications will be filed by BlackRock, according to the prediction of Nate Geraci, who serves as President of ETF Store, within the next few months.

Solana ETFs hold a 70% likelihood of approval according to analyst projections who expect this development to happen before this year ends.

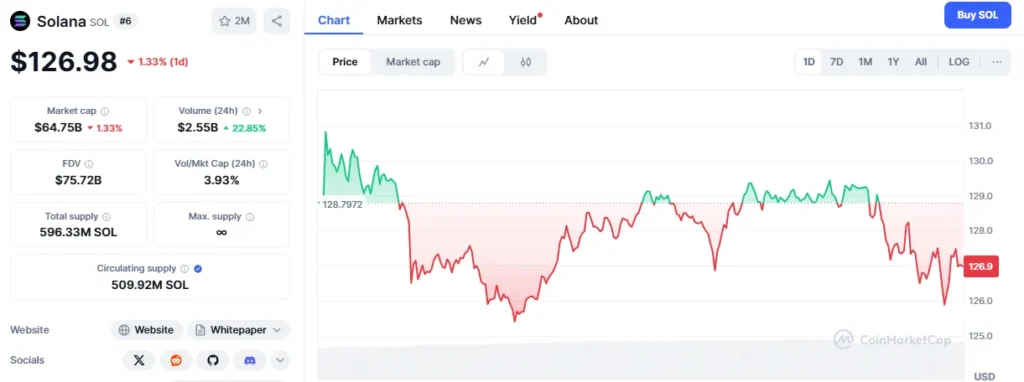

The Price of Solana Today

The cost of Solana currently amounts to $126.56 according to real-time figures, but its value experienced a modest decline of 2.1% throughout the recent day. The price movement of Solana remains mostly steady because institutions are increasingly interested in Solana and futures trading.

Solana expands its leadership position in the crypto space through its increasing number of upcoming product releases. The approval of Solana ETFs by the SEC during 2025 will define blockchain technology status as a retail financial instrument.

FOLLOW US ON WHATSAPP HERE: Stay across all the latest in Solana news, trends, and market analysis via our WhatsApp channel. No comments, no algorithm, and nobody can see your private details.