By Ethan Carter

Strategic (formerly named MicroStrategy) deepened its Bitcoin (BTC) dedication through anotherBitcoin purchase of 130 coins at a $10.7 million total that averaged $82,981 per coin. Between March 10 – March 16 the company acquired 130 BTC in direct contrast to the vast dollar amounts expended during its earlier purchase behemoths.

The substantial BTC purchase brings Strategy’s total assets to 499,226 tokens with a worth of $41 billion that represents 2.3% of the Bitcoin market which has a total supply of 21 million. Through the leadership of Michael Saylor Strategy executed an aggressive acquisition plan which transformed it into a major player in Bitcoin treasuries while generating mixed sentiments from investors.

Smaller Purchases, Big Impact

Though the move stands distinct from past billion-dollar transactions the amount of $10.7 million still carries substantial weight in this context. Strategy reveals its succession of belief in Bitcoin’s future growth through this purchase. The purchased Bitcoin assets with an average cost of $66,360 per BTC amounts to a total investment value of nearly $33.1 billion. By holding substantial Bitcoin assets Strategy maintains a major position of power within the cryptocurrency market despite regular Bitcoin price changes.

The acquisition stems from Strategy’s ongoing efforts to obtain up to $21 billion through perpetual preferred stock STRK as revealed on March 10. The company maintains financial stability through the sale of 123,000 STRK shares which generated $10.7 million allowing it to sustain buying additional Bitcoin for its reserve.

The STRK program functions as a component within a broader debt approach which Strategy implements to expand their Bitcoin treasury holdings. The funding from a zero-coupon convertible note offering of $2 billion enabled Strategy to acquire 20,356 BTC at a price of $97,514 each before using the funds to pay for its $1.99 billion purchase.

Bitcoin’s Market Moves and Strategy’s Position

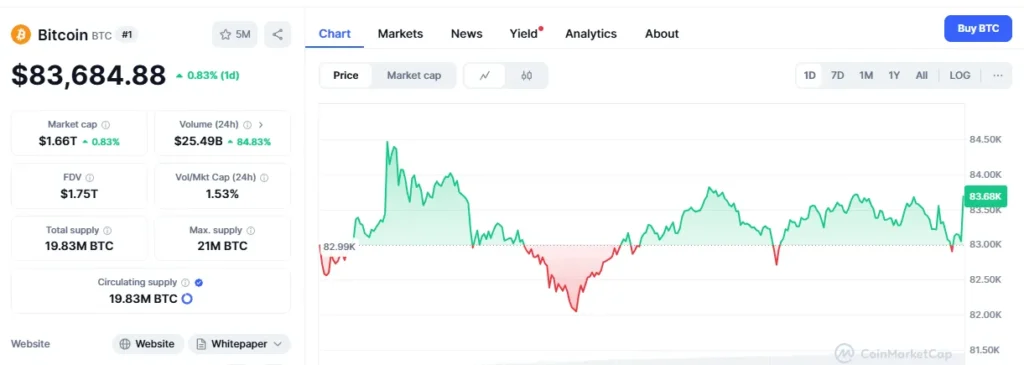

The market value movements of Bitcoin directly impact the price of MSTR stock which is Strategy’s stock symbol. The company reached its historical stock price maximum at $473.83 in November 2024 while going through subsequent substantial downward pressure which cut the value by 39% during the current year and produced a decrease of almost 50% from its peak.

An identical price decline occurred for Bitcoin when it lost 29% of value starting from its peak at $109,000 and reaching below $77,000 recently. Anxiety grows among investors because Bitcoin’s current market value has reached a point within 15% of Strategy’s overall acquisition costs. The trend toward decreasing Bitcoin prices worries many investors because it might push Strategy to sell its Bitcoin assets when this pattern keeps going or a protracted bear market emerges.

The Long-Term Vision: Is Strategy at Risk?

K33’s Head of Research Vetle Lunde argues against the significance of Strategy’s average entry price by highlighting that the company’s debt structure together with its long-term strategy act as defensive mechanisms against short-term market volatility. The debt instruments Strategy offers extend over five to six years thus precluding any necessity to sell its Bitcoin stock for an unexpected period regardless of market value change.

The company should put its focus on maintaining long-term holdings in Strategy because Saylor’s team stands behind Bitcoin’s dual role as economic value storage and national currency asset in the future.

Bitcoin’s Role in the Broader Economy

The global economic position of Bitcoin continues to grow stronger after President Trump issued his executive order on March 6, 2025 for the U.S. Strategic Bitcoin Reserve. Government authorities in the U.S. currently hold an estimated 200,000 BTC tokens worth $18 billion which came from legal seizure of criminal assets. The executive order tasks Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick with developing financing methods that will help strategically acquire Bitcoin through fiscally conservative means.

Many entities now understand Bitcoin stands as a vital strategic framework thus governments and private corporations actively embrace it. The strategic Bitcoin reserve at Strategy holds promise for inspiring future actions from institutional players throughout the coming years.

Bitcoin operations at Strategy along with other institutional uses of the cryptocurrency await future developments.

The Bitcoin strategy of Strategy operates with a long-term perspective even though market volatility recently shook the sector. As the company positions itself as a primary Bitcoin treasury within the financial world it holds approximately half a million Bitcoin in its reserves. The entire value realization process for Bitcoin on the global platform seems to be waiting patiently during this period of market volatility.

Strategy faces a pivotal task to manage its Bitcoin acquisition while meeting investor expectations when MSTR stock experiences increasing market pressure. Strategy stands to become one of the most powerful cryptocurrency industry participants through its possession of 500,000 Bitcoin units should Bitcoin prices recover within coming years.

Join our WhatsApp platform here to receive crypto news updates alongside market analysis and trending market trends. The content platform has no selection process for user records while keeping individual details private to both the system and other users.