The cryptocurrency market has provided investors with steep and unfavorable price changes. Crypto stocks face severe declines, while Bitcoin and altcoins face adversities in bearish trading conditions.

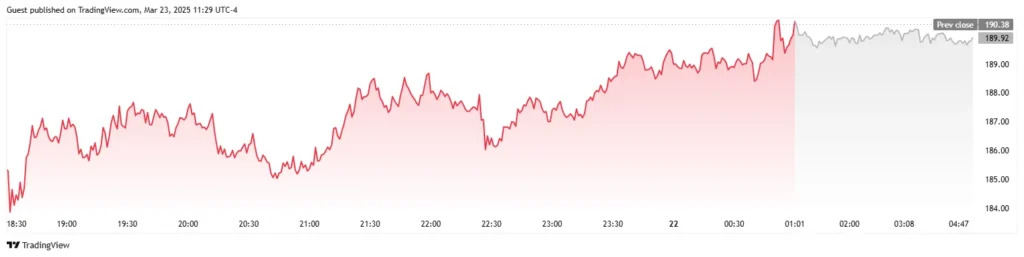

Coinbase operates the largest cryptocurrency exchange in the U.S. Its stock value of $350 in November has diminished to only $190 today. The stock market value of $38 billion quickly vanished from $86 billion to $48 billion. Ouch.

The firm Strategy follows its name change from MicroStrategy under the leadership of Michael Saylor. The market capitalization of Strategy suffered a $27 billion loss since last year when it operated as MicroStrategy due to the current market decline. The 499,226 Bitcoins they own have failed to protect them from the market slide.

Robinhood and Miners Feel the Pain

Robinhood’s stock price faces washout alongside other affected companies. The company’s stock market value has collapsed by $18 billion after dropping from $66.85 earlier this year to its current price of $45. Crypto represents an expanding segment within their business model despite their leading position in retail trading, and they are preparing to acquire BitStamp before the end of the year.

Bitcoin mining stocks?

They’re hurting, too. The devaluation of Mara Holdings from Marathon Digital exceeded $4.6 billion because BTC price fluctuations minimized their profits. All the major mining companies, such as Riot Blockchain, Core Scientific, CleanSpark, Hut 8, and TeraWulf, continue losing billions. Mining cryptocurrency becomes more difficult because current rewards fail to match available resources.

Bitcoin and Altcoins in Free Fall

Why the chaos? People can verify the decline of the cryptocurrency market by examining today’s crypto prices. Bitcoin rates dropped by $24,300 from their top value of $109,300 in January until they reached their current $85,000 level. The price performance of altcoins remains even worse than Bitcoin since the Solana meme coins were demonstrated earlier. Due to their downward performance, the combined market value of these companies decreased by $18 billion.

CoinMarketCap statistics indicate the crypto market lost $1 trillion, dropping from $3.7 trillion in 2024 to $2.7 trillion in the present year. The entire trillion-dollar amount disappeared from existence. Crazy, right?

Trump and SEC Can’t Stop the Slide

The Trump administration’s pro-crypto attitude should have received better support. The administration has been fostering the idea of a Strategic Bitcoin Reserve as part of its plan to develop the United States into a crypto leader.

The SEC reduced its legal action against Coinbase, Ripple Labs, and Kraken. I discussed their task force pivot in my earlier report, and then it seemed like better conditions were in front of them. However, the market refuses to accept the bullish outlook at this time.

Bull or Bear? Analysts Are Split

So, what’s next? The analysts make conflicting predictions. For example, the analysts at Standard Chartered issued an astonishing Bitcoin price prediction, anticipating reaching $500,000 within the long term. Such positive views play a critical role in sustaining dreams.

Market analyst Ki Young Ju from CryptoQuant presents opposing evidence against upcoming market gains. According to him, the bull run has ended because his entire set of indicators shows a bearish perspective. Following my discussions about Fidelity’s Solana investments and Tornado Cash updates, I begin to speculate whether the current market decline will persist as a temporary bump or transform into a prolonged crash.

Either way, it’s a wild ride. Crypto stocks could recover, although they might fail to reclaim previous gains. I sit here with my coffee while the market situation reveals itself. What’s your take?