The entire cryptocurrency market remains under elevated stress due to legitimate causes. The market values of Bitcoin, along with Ethereum, XRP, and Cardano, have decreased significantly because major U.S. stock indices, the S&P 500 and Nasdaq 100, display the feared “death cross.” The cryptocurrency Bitcoin experienced a considerable decrease between its 2025 maximum value of $109,300 and its March 10 price low at $77,396.43, while all altcoins suffered equally severe losses. Historically, crypto and stocks have tracked each other as high-risk assets; thus, the dual technical indicators suggest further market depreciation. The combination of a negative Bitcoin death cross trend and stock market declines throughout the S&P 500 and Nasdaq 100 creates significant trading concern that will require further analysis.

Bitcoin and Altcoins Take a Beating

Bitcoin’s (BTC) unstable price currently shows a minor 0.34% daily growth, though its performance remains seriously lower than its yearly peak at $77,396.43 throughout March 2022. The ETH cryptocurrency value has suffered a steep decline below $1,900 due to a 1.37% daily price drop. The XRP price increased by 1.36% to $2.1, yet Cardano (ADA) maintained an unimpressive minimal gain of 0.03% at $0.65. The crypto market shows panic through sinking index readings of altcoin season at 15, while showing 25 in fear and greed. Total market cap? Down over $1 trillion this year. Ouch.

Market instability affects all risk assets today, resulting in a substantial decline that U.S. stock markets are especially driving. Equities sneezes lead crypto into contracting ill health due to their strong correlation. The situation stands closer to pneumonia conditions than ordinary pneumonia.

Death Cross Hits S&P 500 and Nasdaq 100

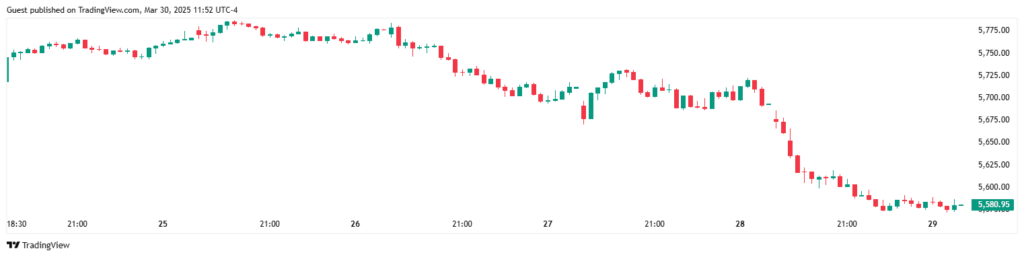

The S&P 500 fell by about 10% since reaching its 2025 high point, and the Nasdaq 100 technical subset weakened by 13% to $19,280. A death cross currently appears on both indices as their 50-day moving average trends beneath the 200-day moving average. The Nasdaq experienced this situation once in 2022 when it suffered a 40% decline during the entire year. The past offers us warnings that act better than fortune-telling.

What’s driving the equity rout? Two big culprits. The AI trend has become substantially less exuberant in recent times. According to your data, NVIDIA, alongside AMD, Microsoft, SoundHound, and C3.ai, experienced the sector cooling as their market capitalization fell from $3.4 trillion to $3.6 trillion. However, it contained a typo, indicating a market reduction. The prospect of trade protectionism under Donald Trump makes economists fear that a recession will strike. Scarcity makes risk assets frown, which becomes worse with twice the risk exposure.

Why Crypto’s on Thin Ice

The Bitcoin death cross scenario exists in real time because its 50-day and 200-day moving averages show signs of meeting (this condition remains unverified in your analysis). Crypto and stocks maintain a long-standing relationship since they strengthen each other’s performance in peak periods and simultaneously decline in value. The cryptocurrency market has demonstrated serious intent through its more significant price decline than the S&P 500 this year. The downward indicators from Nasdaq and S&P could lead to a difficult period for Bitcoin, ETH, XRP and ADA.

The current value of the altcoin season index (15) indicates traders expect no major market upward movement. Fear remains at 25, while losing one trillion dollars from the crypto market produces no signs of trust. A death cross lock for Bitcoin would signal an upcoming market crisis.

Could this flip? The market could witness two possible outcomes: moderation from tariff discussions or the return of artificial intelligence advancements. The market charts indicate that investors need to prepare for the worst ahead. You should monitor the moving averages since this market storm does not show signs of stopping.