Introduction

The cryptocurrency market has evolved significantly over the past decade, transforming from a niche investment area to a mainstream financial asset class. As digital currencies gain widespread adoption, platforms that facilitate crypto trading have become increasingly important for investors. Two of the most prominent platforms in this space are Coinbase and Robinhood, each offering distinct approaches to cryptocurrency investment.

For investors looking to enter the crypto market or expand their existing portfolio, choosing the right platform is crucial. This decision impacts not only the cost of transactions but also the range of available cryptocurrencies, security measures, and additional features that enhance the investment experience.

This article provides a comprehensive comparison of Coinbase and Robinhood, examining their key features, fee structures, cryptocurrency offerings, security protocols, user experience, and regulatory compliance. By understanding the strengths and limitations of each platform, investors can make informed decisions aligned with their investment goals and preferences.

Company Backgrounds

Coinbase: The Crypto-First Pioneer

Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase emerged as one of the earliest and most trusted cryptocurrency exchanges in the United States. The company’s mission has consistently centered around creating an open financial system, making cryptocurrency accessible to average users while maintaining high security standards.

Coinbase went public in April 2021 through a direct listing on NASDAQ under the ticker symbol COIN, marking a significant milestone for the cryptocurrency industry. As of 2025, Coinbase has established itself as the largest cryptocurrency exchange in the United States, serving over 98 million verified users across more than 100 countries.

The platform has expanded its offerings significantly since its inception, evolving from a simple Bitcoin exchange to a comprehensive cryptocurrency ecosystem that includes a professional trading platform (Coinbase Advanced), a self-custody wallet (Coinbase Wallet), and institutional services (Coinbase Prime).

Robinhood: Democratizing Finance

Robinhood Markets, Inc. was founded in 2013 by Vladimir Tenev and Baiju Bhatt with the goal of democratizing finance for all. The platform initially gained popularity by offering commission-free stock trading, disrupting the traditional brokerage model that charged per-trade fees.

In 2018, Robinhood expanded its offerings to include cryptocurrency trading, allowing users to buy and sell select cryptocurrencies alongside traditional investments like stocks, ETFs, and options contracts. Robinhood went public in July 2021, trading on NASDAQ under the ticker symbol HOOD.

Unlike Coinbase, Robinhood positions itself as a multi-asset platform where cryptocurrency is just one component of a broader investment strategy. The company has continued to expand its crypto offerings, recognizing the growing demand from its primarily younger user base.

Platform Comparison

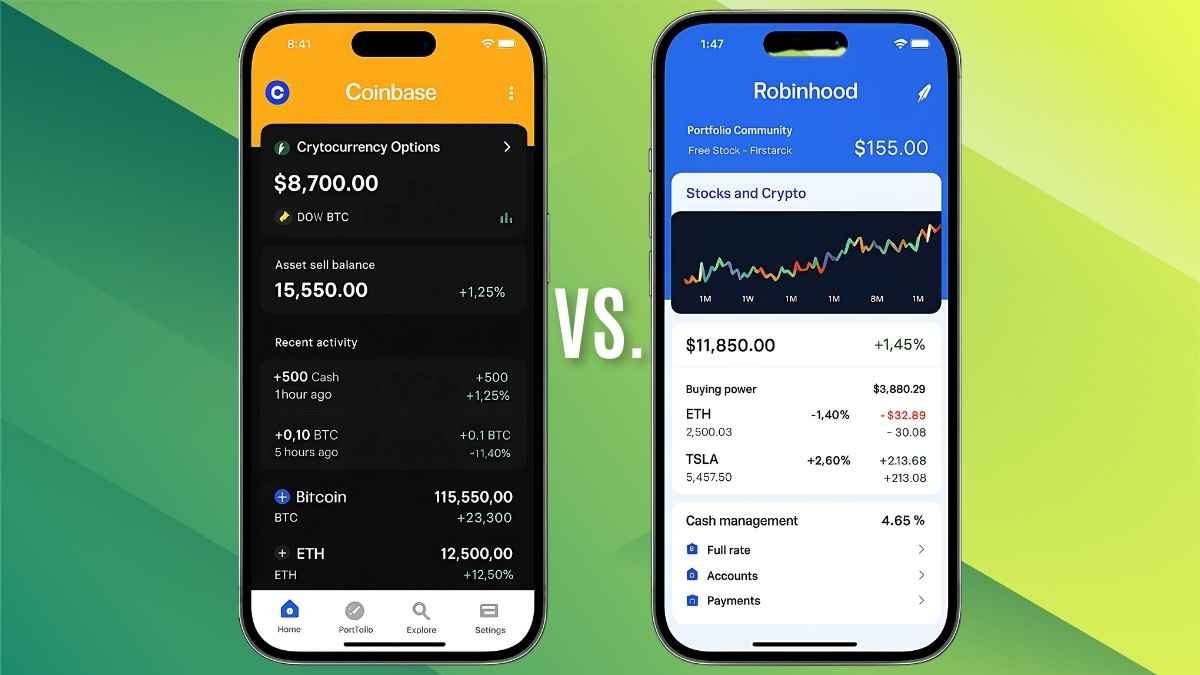

Trading Experience and User Interface

Coinbase

Coinbase offers two distinct trading experiences:

- Coinbase (Simple): Designed for beginners, this user-friendly interface allows for straightforward buying, selling, and managing of cryptocurrencies. The simple design prioritizes accessibility over advanced features, making it ideal for newcomers to cryptocurrency.

- Coinbase Advanced: Previously known as Coinbase Pro, this platform caters to experienced traders with features like advanced charting tools, order books, trade history, and multiple order types (market, limit, stop). The interface is more sophisticated, providing detailed market data and trading capabilities.

The Coinbase mobile app mirrors the functionality of the web platform, offering a seamless experience across devices. The app consistently ranks among the top finance applications in both the Apple App Store and Google Play Store.

One notable feature of Coinbase is its educational content, including “Learn and Earn” programs that reward users with free cryptocurrency for completing educational modules about various digital assets.

Robinhood

Robinhood’s interface is designed with simplicity and visual appeal as primary considerations. The platform takes a minimalist approach, displaying essential information while avoiding overwhelming users with complex data.

The same streamlined interface is used for all asset classes on Robinhood, creating a consistent experience whether trading stocks, options, or cryptocurrencies. This uniformity is particularly beneficial for investors who diversify across multiple asset types.

Robinhood’s mobile app is known for its intuitive design and ease of use, with real-time market data, customizable watchlists, and news feeds integrated directly into the trading experience. The platform has gradually added more advanced features, including candlestick charts, limit orders, and recurring investments.

In 2025, Robinhood enhanced its cryptocurrency offering with advanced trading tools, including improved charting capabilities and custom price alerts, bringing it closer to dedicated crypto exchanges in terms of functionality.

Comparison

Both platforms prioritize user-friendly interfaces, but with different focuses:

- Coinbase offers a more comprehensive crypto-specific experience with educational resources and specialized trading tools.

- Robinhood provides a more integrated approach that treats cryptocurrency as one of several investment options.

For beginners, both platforms offer accessible entry points, but Robinhood’s simpler interface may be less intimidating. For advanced crypto traders, Coinbase Advanced provides more sophisticated tools and deeper market insights.

Cryptocurrency Selection

Coinbase

Coinbase has established itself as a leader in cryptocurrency diversity, offering an extensive selection of digital assets. As of 2025, the platform supports over 260 cryptocurrencies for trading, including:

- Major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Solana (SOL)

- Established altcoins: Cardano (ADA), Polkadot (DOT), Chainlink (LINK)

- DeFi tokens: Uniswap (UNI), Aave (AAVE), Compound (COMP)

- Stablecoins: USD Coin (USDC), Tether (USDT), Dai (DAI)

- Newer projects: Many emerging cryptocurrencies after they meet Coinbase’s listing criteria

Coinbase also features a robust listing process for new cryptocurrencies, regularly adding support for emerging projects that meet its standards for technology, security, and compliance.

Robinhood

Robinhood takes a more conservative approach to cryptocurrency listings, offering a curated selection of digital assets. As of 2025, the platform supports approximately 35 cryptocurrencies, including:

- Major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Solana (SOL)

- Popular altcoins: Dogecoin (DOGE), Cardano (ADA), Avalanche (AVAX)

- Selected DeFi tokens: Aave (AAVE), Uniswap (UNI)

- Meme coins: Shiba Inu (SHIB), Pepe (PEPE), Bonk (BONK)

While Robinhood’s selection has expanded significantly since its initial crypto offering, it remains focused on established cryptocurrencies with higher market capitalizations and liquidity.

Comparison

The difference in cryptocurrency selection represents one of the most significant distinctions between the two platforms:

- Coinbase offers greater diversity and access to emerging projects, appealing to crypto enthusiasts and those seeking exposure to a wide range of digital assets.

- Robinhood provides a more curated experience, focusing on established cryptocurrencies with proven track records.

For investors primarily interested in major cryptocurrencies like Bitcoin and Ethereum, either platform may suffice. However, for those seeking exposure to a broader range of digital assets or emerging projects, Coinbase provides significantly more options.

Fee Structures

Coinbase

Coinbase employs a tiered fee structure that varies based on the trading platform, transaction size, and payment method:

Coinbase (Simple):

- Transaction fee: Between 1.49% and 3.99% depending on payment method

- ACH transfers: 1.49%

- Debit card purchases: 3.99%

- Wire transfers: $10 (domestic), $25 (international)

Coinbase Advanced:

- Maker fees: 0.4% (decreasing with higher volume)

- Taker fees: 0.6% (decreasing with higher volume)

- For monthly trading volumes exceeding $100,000, fees decrease progressively

Coinbase One Subscription:

- $30 monthly fee

- Zero trading fees

- Enhanced staking rewards

- Priority customer support

Coinbase also charges network fees for cryptocurrency withdrawals, which vary by blockchain and network congestion.

Robinhood

Robinhood has built its reputation on commission-free trading, and this extends to its cryptocurrency offering:

- No commission fees for buying or selling cryptocurrencies

- No account maintenance fees

- No ACH transfer fees

- No withdrawal fees

Instead of explicit fees, Robinhood generates revenue through:

- Payment for order flow

- Spreads between bid and ask prices

- Interest on cash balances

- Premium subscription services (Robinhood Gold)

According to Robinhood’s own analysis (as of March 2025), users get approximately 10.25% more Ethereum when purchasing on Robinhood compared to Coinbase Simple, demonstrating the impact of their lower fee structure.

Comparison

The fee comparison between the two platforms reveals significant differences:

- Coinbase charges explicit fees that are generally higher, particularly for small transactions on the Simple platform. However, Coinbase Advanced offers more competitive rates for active traders, and the Coinbase One subscription provides an alternative for frequent traders.

- Robinhood offers a more straightforward, commission-free model that appeals to cost-conscious investors. However, users should be aware that costs are built into the spread between buying and selling prices.

For investors who prioritize cost minimization, especially those making smaller, frequent trades, Robinhood typically offers better value. For high-volume traders or those requiring advanced features, Coinbase Advanced or Coinbase One may provide comparable or better overall value.

Security Features

Coinbase

Coinbase has invested heavily in security infrastructure, implementing multiple layers of protection:

- Cold Storage: Approximately 98% of customer funds are stored offline in cold storage, protected from online vulnerabilities.

- Insurance Coverage: Maintains commercial crime insurance that covers a portion of digital assets against theft.

- Two-Factor Authentication (2FA): Requires verification through multiple methods, including SMS, authenticator apps, or security keys.

- Biometric Authentication: Supports fingerprint and facial recognition for mobile app access.

- AES-256 Encryption: Customer data is encrypted using bank-level security standards.

- FDIC Insurance: USD balances are covered up to $250,000 per customer.

- Bug Bounty Program: Encourages security researchers to identify and report vulnerabilities.

- Regulatory Compliance: Licensed as a Money Services Business with FinCEN and complies with state-level regulations.

Coinbase has established a strong security track record, with no major breaches of its core platform, though individual user accounts have been compromised through phishing attacks and other external methods.

Robinhood

Robinhood has also implemented robust security measures for its cryptocurrency operations:

- Cold Storage: Stores the majority of customer cryptocurrencies in offline cold storage facilities.

- Crime Insurance: Carries insurance against theft and cybersecurity breaches for crypto assets.

- Two-Factor Authentication: Supports SMS-based and authenticator app 2FA.

- Device Management: Allows users to view and manage devices accessing their accounts.

- FDIC Insurance: Cash balances (but not cryptocurrency) are insured up to $250,000.

- Regulatory Compliance: Robinhood Crypto is licensed by the New York State Department of Financial Services and registered with FinCEN as a money services business.

Robinhood emphasizes that it doesn’t lend customer cryptocurrencies or leverage against them, providing an additional layer of security against the types of risks that affected some crypto lending platforms in recent years.

Comparison

Both platforms maintain high security standards, with similar core protections:

- Coinbase benefits from its longer history as a dedicated cryptocurrency platform, with more robust crypto-specific security measures and a proven track record in the industry.

- Robinhood applies its established financial security infrastructure to cryptocurrency, with particular emphasis on preventing unauthorized access.

While both platforms prioritize security, Coinbase’s specialized focus on cryptocurrency and longer operating history in the crypto space may provide additional confidence for security-conscious investors.

Additional Features and Services

Coinbase

Coinbase offers a comprehensive ecosystem of cryptocurrency services:

Staking and Rewards:

- Supports staking for Ethereum, Solana, Cardano, Polkadot, and other proof-of-stake cryptocurrencies

- Offers interest-earning opportunities on select assets

- Provides educational incentives through “Learn and Earn” programs

Wallet Services:

- Coinbase Wallet: A self-custody wallet that gives users complete control over their private keys

- Supports thousands of cryptocurrencies and decentralized applications (dApps)

- Allows for participation in decentralized finance (DeFi) protocols

Advanced Trading Features:

- Technical analysis tools and advanced order types

- APIs for algorithmic trading

- Real-time market data and order books

Additional Services:

- Coinbase Card: A Visa debit card that allows spending of cryptocurrency with automatic conversion to fiat

- Coinbase Commerce: Merchant solutions for accepting cryptocurrency payments

- Institutional Services: Through Coinbase Prime, offering custody, trading, and data services for institutional investors

Robinhood

Robinhood provides a more integrated approach with features that span multiple asset classes:

Crypto Transfers:

- Supports sending and receiving cryptocurrencies to external wallets

- No withdrawal fees (though network fees still apply)

Multi-Asset Platform:

- Seamless trading across stocks, ETFs, options, and cryptocurrencies from a single account

- Unified portfolio view and performance tracking

- Fractional share investing (extends to select cryptocurrencies)

Trading Tools:

- Basic and advanced charting capabilities

- Customizable price alerts

- Recurring investments for dollar-cost averaging

Additional Services:

- Robinhood Gold: Premium subscription offering higher interest on uninvested cash, advanced market data, and larger instant deposits

- Cash Management: Features that blur the line between investing and banking

- IPO Access: Opportunity to invest in initial public offerings at the IPO price

Comparison

The additional features highlight the different approaches of the two platforms:

- Coinbase offers a more comprehensive and specialized cryptocurrency ecosystem, with particular strength in staking, self-custody options, and DeFi integration.

- Robinhood provides a more integrated experience for investors looking to maintain a diversified portfolio across multiple asset classes, with simpler management and consolidated reporting.

For dedicated cryptocurrency enthusiasts seeking the full range of crypto capabilities, Coinbase provides more options. For investors who view cryptocurrency as one component of a broader investment strategy, Robinhood’s integrated approach may be more convenient.

Regulatory Compliance and Developments

Current Regulatory Status

Both Coinbase and Robinhood operate under significant regulatory oversight in the United States:

Coinbase:

- Registered as a Money Services Business with the Financial Crimes Enforcement Network (FinCEN)

- Licensed as a money transmitter in multiple states

- Publicly traded company subject to SEC oversight

- Complies with Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) requirements

- Implements Know Your Customer (KYC) procedures for all users

Robinhood:

- Robinhood Crypto is licensed by the New York State Department of Financial Services

- Registered as a money services business with FinCEN

- The parent company is a registered broker-dealer with FINRA and the SEC

- Complies with BSA and AML requirements

- Implements KYC procedures across all platform services

Recent Regulatory Developments

The regulatory landscape for cryptocurrency has evolved significantly in 2024-2025, with important implications for both platforms:

- In February 2025, the SEC closed investigations into both Robinhood Crypto and Coinbase without pursuing enforcement actions, signaling a potential shift in regulatory approach.

- The introduction of a new digital assets regulatory framework has created opportunities for both companies to expand their offerings.

- Coinbase may be designated as an alternate trading platform under new regulations, potentially allowing it to list both crypto securities and commodities.

- Robinhood has announced plans to launch crypto futures trading, contingent on regulatory approval.

These regulatory developments reflect a maturing cryptocurrency ecosystem with clearer rules and potentially reduced compliance burdens for established platforms.

Comparison

While both companies maintain strong compliance programs, their regulatory positioning differs slightly:

- Coinbase has been more proactive in engaging with regulators and advocating for crypto-friendly policies, including legal challenges to certain regulatory actions.

- Robinhood benefits from its diversified business model, where cryptocurrency represents only one component of its overall operations, potentially reducing regulatory risk.

For investors concerned about regulatory compliance, both platforms offer a high degree of legitimacy and adherence to existing regulations, though the rapidly evolving regulatory landscape may continue to create both challenges and opportunities.

Financial Performance and Market Position

Coinbase (COIN)

Coinbase has established itself as the leading publicly traded cryptocurrency exchange in the United States. The company’s financial performance has shown significant volatility, closely tied to cryptocurrency market conditions:

- Current Stock Price: $175.03 (as of April 17, 2025)

- Market Capitalization: Approximately $42 billion

- Recent Performance: Coinbase stock has demonstrated strong resilience in 2025, driven by increased trading volumes and diversification of revenue streams.

- Revenue Sources: Trading fees remain the primary revenue driver, though subscription and services revenue (including staking, Coinbase One, and custody fees) has grown to represent a more significant portion of overall revenue.

In its most recent quarterly results, Coinbase reported improved profitability and stable cash reserves, indicating the company’s ability to weather cryptocurrency market fluctuations better than in previous cycles.

Robinhood (HOOD)

Robinhood has positioned itself as a fast-growing competitor in the cryptocurrency space, leveraging its existing user base from traditional financial markets:

- Current Stock Price: $41.18 (as of April 17, 2025)

- Market Capitalization: Approximately $36 billion

- Recent Performance: Robinhood stock has seen strong growth in 2025, with cryptocurrency trading volumes becoming an increasingly important contributor to overall revenue.

- Revenue Diversification: While payment for order flow from equity trading remains significant, cryptocurrency trading has emerged as a major growth driver for the company.

Robinhood reported that its crypto trading volumes surged 400% year-over-year to $71 billion in Q4 2024, demonstrating the platform’s growing importance in the cryptocurrency market.

Competitive Dynamics

The competitive landscape between Coinbase and Robinhood has evolved significantly:

- Robinhood is actively expanding its cryptocurrency offerings, planning to acquire Bitstamp in the first half of 2025 to attract institutional flow and enter the global exchange space.

- Coinbase has responded to fee competition by introducing Coinbase One, providing zero-fee trading through a subscription model.

- Both companies are benefiting from the broader adoption of cryptocurrency, with current market conditions supporting growth for established, regulated platforms.

- Analysts have suggested that while Coinbase maintains leadership in the dedicated crypto exchange space, Robinhood’s integrated model and aggressive growth strategy position it as an increasingly significant competitor.

International Availability

Coinbase

Coinbase has established a global presence, though with varying service levels across different regions:

- Available in over 100 countries across North America, Europe, Asia-Pacific, and select countries in other regions

- Full service offerings in the United States (except Hawaii)

- Coinbase International Exchange serves non-US institutions in select jurisdictions

- Local payment methods supported in many regions

- Compliance with local regulations limits certain features in some countries

Robinhood

Robinhood’s availability remains more limited geographically:

- Primary focus on the United States market, available in all 50 states, Washington D.C., Puerto Rico, and the U.S. Virgin Islands

- Recently expanded crypto trading, deposit, and withdrawal functionality to customers in the European Union

- Limited international expansion planned, with regulatory compliance requirements presenting significant barriers to entry in many markets

- The acquisition of Bitstamp is expected to accelerate international growth

Comparison

The difference in international availability represents another significant distinction between the platforms:

- Coinbase offers broader global access, making it the only option of the two for users in most countries outside the US and EU.

- Robinhood’s international limitations reflect its core focus on the US market, though recent expansion efforts suggest growing international ambitions.

For US-based investors, either platform is fully accessible, but international users will generally find Coinbase to be more readily available in their regions.

Which Platform Is Right for You?

Choose Coinbase if:

- You want access to a wide selection of cryptocurrencies beyond the major coins

- You’re interested in staking, earning rewards, or exploring DeFi applications

- You need self-custody wallet options with direct control over your private keys

- You prioritize advanced trading features specific to cryptocurrency

- You’re located outside the United States where Robinhood isn’t available

- You’re willing to pay higher fees for a more comprehensive crypto ecosystem

Choose Robinhood if:

- You want to trade cryptocurrencies alongside stocks, ETFs, and options in a single account

- You prioritize minimizing trading costs, especially for smaller transactions

- You’re primarily interested in major cryptocurrencies like Bitcoin and Ethereum

- You prefer a simpler, more streamlined user interface

- You’re a US-based investor looking for an integrated investment platform

- You’re new to cryptocurrency and prefer a less intimidating entry point

Consider Both if:

- You’re an active investor who might benefit from using specialized platforms for different purposes

- You want to compare real-time pricing and spreads to optimize your trading costs

- You’re interested in experimenting with different features before committing to a single platform

Conclusion

The comparison between Coinbase and Robinhood reveals two fundamentally different approaches to cryptocurrency investment. Coinbase offers a specialized, feature-rich cryptocurrency ecosystem that caters to enthusiasts and serious crypto investors. Robinhood provides a streamlined, cost-effective way to add cryptocurrency exposure to a diversified investment portfolio.

As we progress through 2025, both platforms continue to evolve, with Coinbase expanding its service offerings beyond traditional exchange functions and Robinhood enhancing its cryptocurrency capabilities. The recent favorable regulatory developments have created a more stable operating environment for both companies, potentially accelerating innovation and competition.

For investors, the choice between these platforms should align with their specific investment goals, cryptocurrency interests, and preferences regarding costs, features, and user experience. Many active investors may even find value in maintaining accounts on both platforms, leveraging the strengths of each for different aspects of their cryptocurrency strategy.

As the cryptocurrency market continues to mature, platforms like Coinbase and Robinhood play crucial roles in expanding access and improving the user experience for digital asset investors. Their ongoing development and competition ultimately benefit the broader cryptocurrency ecosystem by driving innovation, reducing costs, and increasing mainstream adoption.

Coinbase vs Robinhood – Feature Comparison (2025)

| Feature | Coinbase | Robinhood |

|---|---|---|

| Primary Focus | Dedicated cryptocurrency platform | Multi-asset investment platform |

| Cryptocurrency Selection | 260+ cryptocurrencies | ~35 cryptocurrencies |

| Trading Fees | Simple: 1.49-3.99% Advanced: 0.4% maker/0.6% taker Coinbase One: $30/month for zero fees | Commission-free (costs built into spread) |

| Security Features | Cold storage, insurance, 2FA, biometric auth | Cold storage, insurance, 2FA, device management |

| Mobile App | Comprehensive with advanced features | Streamlined with intuitive interface |

| Staking Services | Extensive staking options for multiple cryptocurrencies | Limited staking options |

| Self-Custody Option | Coinbase Wallet with full control of private keys | No dedicated self-custody wallet |

| Transfers to External Wallets | Supported for most cryptocurrencies | Supported, no withdrawal fees |

| Additional Services | Coinbase Card, Commerce, Institutional | Stock trading, options, ETFs, IPO access |

| International Availability | 100+ countries | US and limited EU access |

| Ideal For | Dedicated crypto investors seeking variety and features | Multi-asset investors wanting simplified crypto exposure |

Coinbase vs Robinhood – Price Comparison Example

| Transaction | Coinbase Simple | Coinbase Advanced | Robinhood |

|---|---|---|---|

| $100 BTC Purchase | $1.49-$3.99 fee | $0.60 fee (taker) | Commission-free |

| $1,000 ETH Purchase | $14.90-$39.90 fee | $6.00 fee (taker) | Commission-free |

| $10,000 SOL Purchase | $149.00-$399.00 fee | $60.00 fee (taker) | Commission-free |

| Monthly Active Trading | High fees without subscription | Moderate fees, volume discounts | Low implicit costs via spread |

| Withdrawal to External Wallet | Network fee | Network fee | Network fee only |

Note: Fees are approximate and subject to change. Robinhood’s commission-free model includes costs built into the spread between buy and sell prices.