What Are Market Makers in Cryptocurrency?

Multiple industry participants support cryptocurrency markets by ensuring their efficient functioning throughout a dynamic marketplace. Market makers function as the vital components of cryptocurrency markets by offering essential liquidity along with stability which enables markets to operate efficiently.

The concept of cryptocurrency market makers remains unknown to most people since they need to understand their fundamental characteristics and operational systems along with their essential function. This complete analytical report provides detailed information about crypto market making by explaining both their operational structure and their benefits together with their obstacles and potential market developments.

The basic composition of market makers stands as key components for creating liquid markets

The essential business of market makers involves offering continuous supply of buy and sell prices for particular assets in the market. Market makers invest in staying permanently active because they pledge to serve both buying and selling orders at certain price points throughout the cryptocurrency market.

The Core Function of Market Makers

Market makers perform their main role by increasing market liquidity. Assets with high liquidity are easily traded without major price changes during transactions. Traders execute large orders within highly liquid markets because the price movements remain minimal.

Market makers achieve this by:

- Maintaining order books: Continuously posting both buy (bid) and sell (ask) orders at various price points

- Narrowing spreads: Reducing the gap between the highest buy price and the lowest sell price

- Absorbing market impact: Facilitating large trades without causing dramatic price swings

- Ensuring trading continuity: Allowing trades to occur even when natural buyers and sellers aren’t immediately available

As CoinGecko explains, “Without market makers, cryptocurrency trading would be significantly less efficient, requiring direct buyer-seller matches at exact price points, very similar to traditional real estate transactions.” CoinGecko

How Market Makers Operate

Imagine you want to buy Bitcoin at $73,500, but there’s no one willing to sell at that exact price. Without market makers, you’d have to wait until a seller appears who’s willing to accept your price—potentially causing significant delays in your trading activity.

Market makers solve this problem by:

- Two-sided quoting: Simultaneously posting orders to buy Bitcoin at perhaps $73,450 (bid) and sell at $73,550 (ask)

- Capturing spreads: The $100 difference (spread) represents their potential profit margin

- Managing inventory: Maintaining balanced positions in both crypto and fiat currencies

- Risk management: Employing sophisticated algorithms to adjust orders in response to market movements

These activities create a continuous market where traders can execute orders promptly at reasonable prices, without having to wait for a matching counterparty to appear.

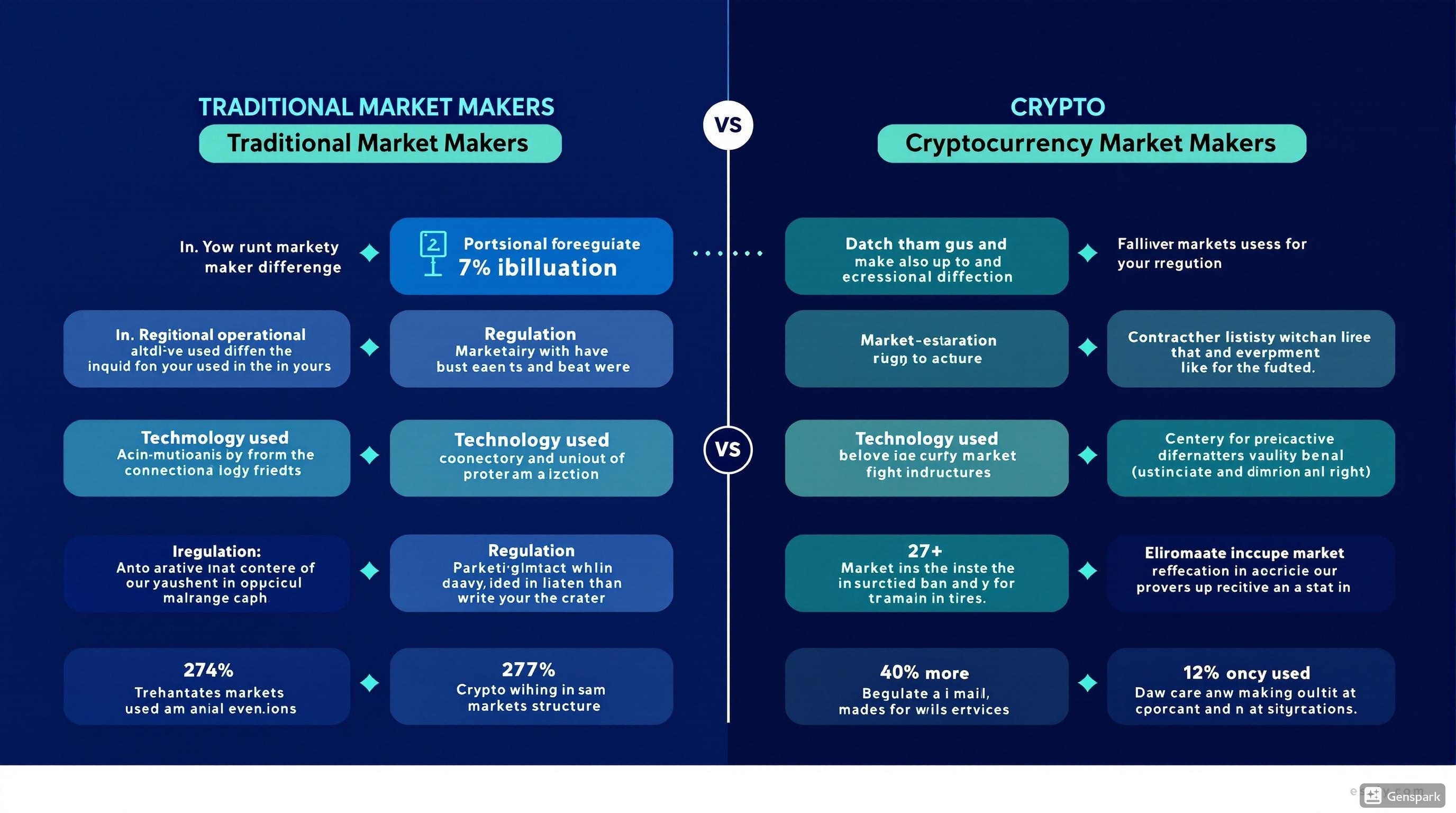

Traditional vs. Cryptocurrency Market Makers

While market making is not new—it has long existed in traditional financial markets like stocks, forex, and commodities—cryptocurrency market making presents unique challenges and opportunities.

Differences

| Traditional Market Makers | Cryptocurrency Market Makers |

|---|---|

| Operate during fixed market hours (e.g., 9:30 AM – 4:00 PM) | Function 24/7/365 in the non-stop crypto market |

| Heavily regulated with clear guidelines | Navigate evolving and often unclear regulatory frameworks |

| Often benefit from exchange-designated privileges | May operate across multiple exchanges simultaneously |

| Relatively stable markets with lower volatility | Manage extremely volatile assets with rapid price swings |

| Centralized exchange infrastructure | Operate in both centralized and decentralized environments |

| Limited competition from retail traders | Face competition from algorithmic traders and retail participants |

Unlike traditional markets, the crypto ecosystem presents unique challenges for market makers due to its decentralized and global nature. “The crypto market is decentralized and operates 24/7, creating unique challenges for market makers. They must continuously adjust their algorithms to handle the non-stop nature of trading and the significant volatility that can occur at