📅 March 18, 2025 – By Ethan Carter, BlockNewsX

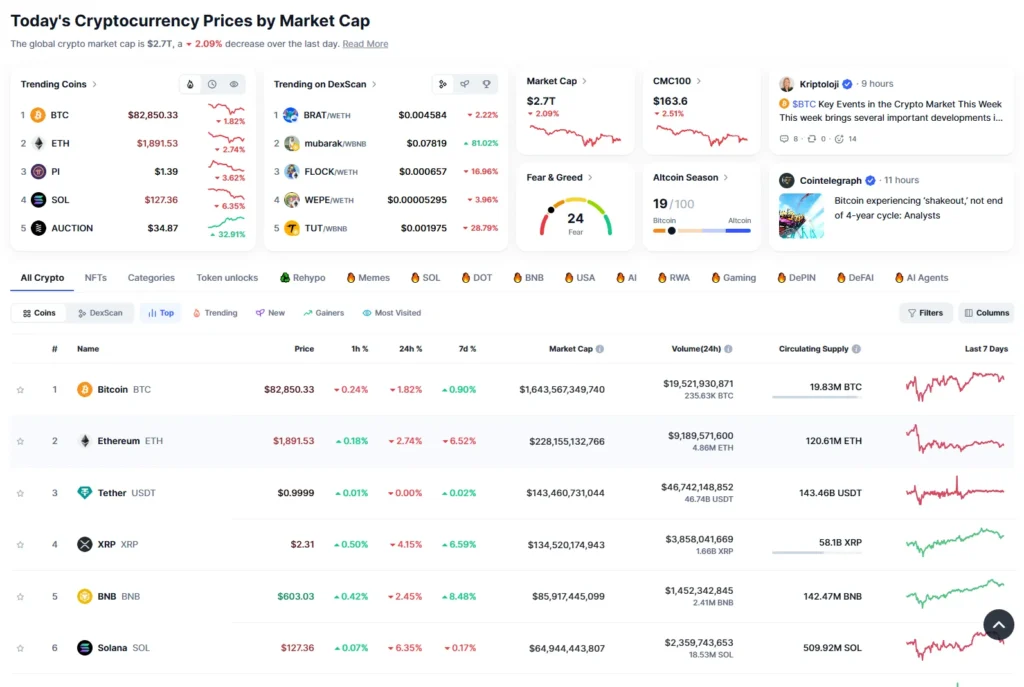

The crypto market is shifting rapidly, and as predicted, Bitcoin has shown significant volatility after a brief period of stagnation. As always, 7 PM marks a pivotal moment in the market’s momentum, as it often signals a major price movement. Today, we discuss the latest updates, key trading signals, and insights into what’s next for Bitcoin and other top cryptocurrencies.

Bitcoin’s Recent Movement and Market

As predicted, the market experienced a sharp drop after hitting a plateau. Bitcoin (BTC) touched a low of $82,400 before bouncing back with a strong recovery to around $85,000—showing a $2,600 to $3,000 price rotation. This quick change reflects the volatile nature of Bitcoin, which often traps investors in price fluctuations.

What Does This Mean for Traders?

Bitcoin’s fluctuations are a reminder of the volatile market crypto traders are accustomed to. Moving forward, Bitcoin’s price fluctuations between $83,500 and $86,000 could set the tone for the next few hours. If Bitcoin continues its downward trend, we might see support levels around $83,500 before any potential recovery or bullish breakouts.

📌 Bitcoin Trading Tip: Always keep an eye on market trends and never get caught in the price traps. The volatility can be intense, but it also offers trade opportunities for those who are prepared.

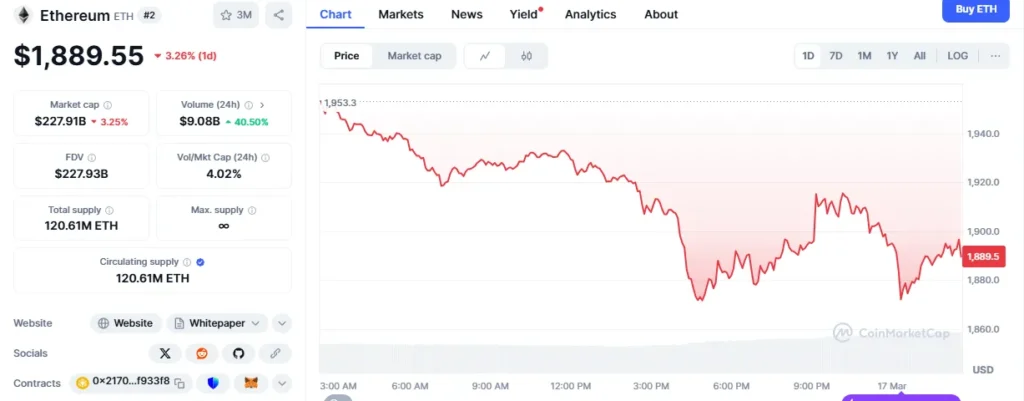

Ethereum’s Struggles and Recovery

While Bitcoin surged, Ethereum (ETH) faced challenges, struggling to break the $1,945 resistance level. The price briefly reached $1,934 before dropping back, which led to a failure to break the resistance. For traders, this highlights the importance of understanding resistance zones in the crypto market.

Ethereum’s Support Levels

Ethereum has strong support around $1,900 and $1,880. If the price fails to hold these levels, a drop to $1,850 could be expected. However, any bullish momentum might push Ethereum back to the $1,945-$1,960 range.

📌 Ethereum Trading Tip: Focus on resistance and support zones and avoid emotional trading during price dips. Staying patient could yield better returns.

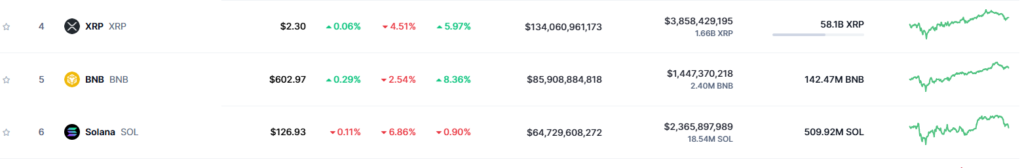

Key Altcoins: XRP, BNB, and Solana

Today, we’re seeing a significant rise in XRP’s movements, especially after its exclusion from daily analysis previously. Many viewers have asked why XRP was removed, and today I’m reinstating it due to its strong movement potential. XRP is currently testing its support and resistance levels between $2.18 and $2.34.

BNB and Solana Movements

BNB has shown impressive resilience, bouncing back to $608 after a low of $593. The support remains at $600, and breaking this level could lead to further downward movement. For Solana, the support is at $130, with a resistance at $135.

📌 Altcoin Trading Tip: Keep a close watch on support and resistance levels for altcoins like BNB and Solana, and adapt quickly to price changes.

Key Risk and Safety Reminders

While the market is full of opportunities, it is crucial to remember the importance of safety when trading in volatile conditions. A big reminder for all crypto traders—never transfer your funds to anyone unless you are certain of their credibility. Scams and fraudulent schemes remain a significant risk in the crypto space. Always use trusted exchanges and protect your investments.

📌 Trading Safety Tip: Don’t share your portfolio or transfer funds to untrusted sources. Always trade responsibly and be aware of security risks.

The Final Out: BTC and ETH

Today’s market is shaping up to be volatile, with Bitcoin and Ethereum showing signs of both upward potential and downward risk. Traders need to stay alert, focusing on key support and resistance levels to maximize gains while minimizing risk.

🔹 BTC: Expect potential movement between $83,500 and $86,000.

🔹 ETH: Monitor the $1,900 support level and $1,945 resistance level.

📢 What are your thoughts on Bitcoin and Ethereum’s market movements today? Let us know in the comments below.

FOLLOW US ON WHATSAPP HERE: Stay across all Bitcoin news, trends, and market analysis via our WhatsApp channel. No comments, no algorithm, and nobody can see your private details.

Disclaimer: The information in this article is for educational and informational purposes only. It does not constitute financial advice. Always do your own research before making investment decisions.