Crypto’s rollercoaster keeps spinning in the last week of March 2025. This recap unpacks the moves shaking the digital asset world from Terra’s new lifeline for burned investors to Trump’s bold pardons and a Polymarket scare. Buckle up—here’s what went down.

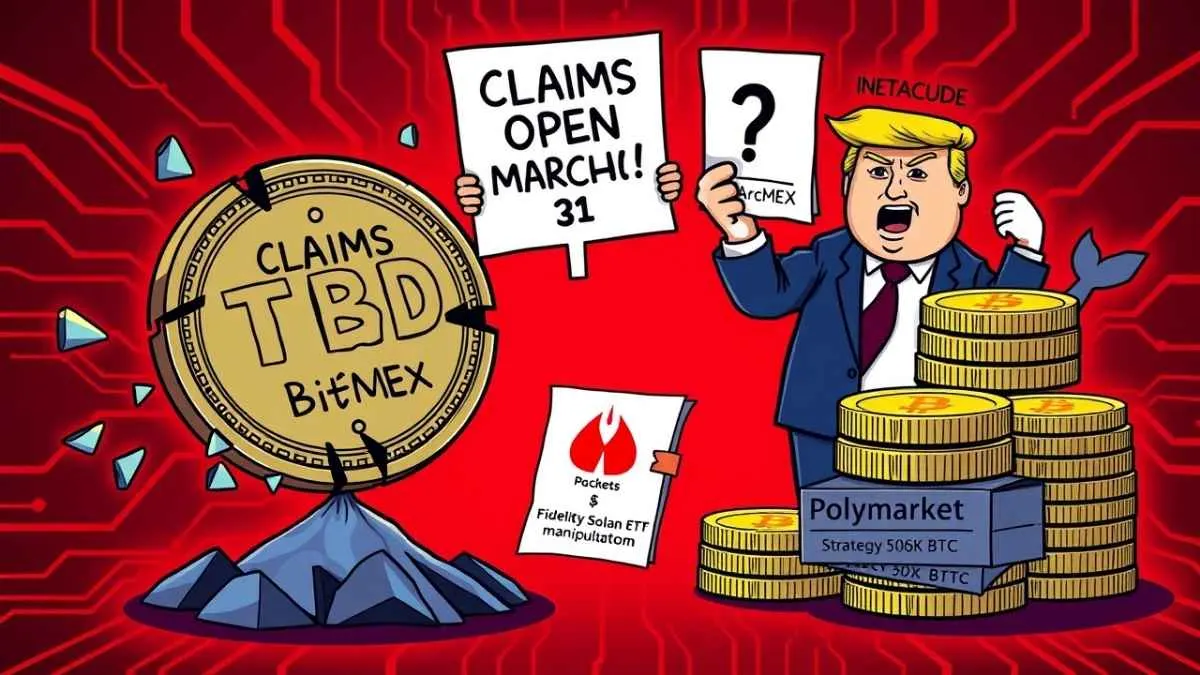

Terra’s Claims Portal: Shot at Redemption

Terraform Labs is throwing a rope to investors sunk by the 2022 Luna and TerraUSD (UST) collapse. Starting March 31, a new online portal at claims.terra.money lets victims file for losses—but the clock’s ticking. You’ve got until April 30 at 11:59 p.m. ET to stake your claim, or you’re out of luck. Late filers? Zero recovery. It’s a gritty reboot for a project that once torched billions, tied to a $4.47 billion SEC settlement bankrolled by Do Kwon’s assets. Will it heal old wounds or just stir the pot?

Trump Pardons BitMEX Founders: Crypto’s Get-Out-of-Jail Card

President Donald Trump dropped a bombshell, pardoning BitMEX co-founders Arthur Hayes, Benjamin Delo, and Samuel Reed. The trio had copped to Bank Secrecy Act violations—skipping anti-money laundering and KYC checks—back in 2022. Now, they’re off the hook, sparking cheers and jeers. Some hail it as a pro-crypto flex; others on X call it a justice dodge. Is this a sign Trump’s doubling down on digital assets—or just a flashy one-off?

SEC Backs Off: Crypto.com and Immutable Breathe Easy

The SEC’s playing nice for once. Crypto.com announced on March 27 that its investigation’s been axed—no charges, no fuss. It’s the latest in a string of dropped probes, with Immutable, Ripple, Coinbase, and even “Hawk Tuah Girl” reportedly off the hook too. Immutable’s case, tied to a Wells notice from October, wrapped up without a fight, covering the firm, its IMX Ecosystem Foundation, and CEO Robbie Ferguson. Is the SEC softening, or just picking its battles?

Hyperliquid Goes Spot: Growth Meets Whale Drama

Hyperliquid’s stepping up, rolling out direct deposits and withdrawals for spot trading on March 27. The decentralized exchange (DEX) is flexing its muscles—but not without turbulence. A day earlier, a whale dumped the Solana meme coin JELLY while another user shorted it, roiling the market. Manipulation or just DEX life? Either way, Hyperliquid’s expansion signals bigger ambitions in a crowded field.

Tether’s USDT0 Spreads Wings on Optimism

Tether’s USDT0 stablecoin stretches across Optimism’s Superchain, hot off its Kraken Ink Layer 2 debut. As of March 27, it’s live on OP Mainnet, with more rollouts planned. This multi-chain push promises smoother, faster stablecoin flows—could it nudge USDT0 into the big leagues alongside its $140 billion sibling, USDT?

SBF’s New Digs: Oklahoma City Transfer

Sam Bankman-Fried, the fallen FTX kingpin, is on the move. The Federal Bureau of Prisons updated his status on March 27—he’s now at the Oklahoma City Federal Transfer Center. No word on why, but it’s a fresh chapter for the ex-CEO whose empire imploded in 2022. posts speculate: halfway house next?

Wyoming’s Stablecoin Dream Takes Shape

Governor Mark Gordon’s got crypto fever. At Wednesday’s Digital Chamber DC Blockchain Summit, he unveiled Wyoming’s plan for a state-issued “stable token.” Touted as a nimble, crypto-friendly move, Gordon bragged, “We can turn on a dime.” Testing’s underway—could Wyoming beat others to the punch by July?

Polymarket’s Wild Ride: Governance Under Fire

Polymarket’s prediction markets hit a snag. Between March 24-25, a $7 million bet—“Ukraine agrees to Trump mineral deal before April?”—jumped from 9% to 100% odds, screaming manipulation. The platform fessed up, pointing fingers at its UMA oracle provider. Coordinated or glitch? It’s a black eye for the crypto betting star, and X users aren’t holding back.

Fidelity’s Solana ETF Bet

Fidelity’s eyeing Solana. The $5 trillion asset manager filed with the SEC on March 25 for a spot Solana ETF, with Cboe Exchange submitting a 19b-4 listing form. It follows Fidelity’s Solana Fund registration in Delaware last week. If approved, it’d join Bitcoin and Ethereum ETFs—another mainstream nod to altcoins.

Dogecoin’s $1.8 Million Power Play

The Dogecoin Foundation’s corporate arm, House of Doge, snapped up 10 million DOGE for $1.8 million. Launched in February with a five-year mission, House of Doge wants to pivot DOGE from meme status to payment king. A savvy reserve strategy—or a long shot?

Strategy’s Bitcoin Haul Tops 500K

Michael Saylor’s Strategy isn’t slowing down. The firm grabbed 6,911 BTC for $584.1 million this week, averaging $84,529 per coin. That pushes its stash to 506,137 BTC, bought for $33.7 billion since 2020. At today’s $86,024 price, it’s a flex of faith in Bitcoin’s staying power.