Crypto took a beating overnight after the U.S. slammed a 104% tariff on Chinese imports, effective 12:01 AM EDT today, April 9. The move—a bold escalation in the U.S.-China trade spat—sparked panic selling, tanking Bitcoin, Ethereum, and most altcoins in hours. The global crypto market cap shed nearly 4%, dipping to $2.43 trillion per Coinpedia, as traders bolted for the exits. It’s a stark reminder: even digital assets aren’t immune to geopolitical punches. Posts on X are buzzing with worry—@IamChiscoh asked if this could “dip the market more,” and it sure looks that way so far.

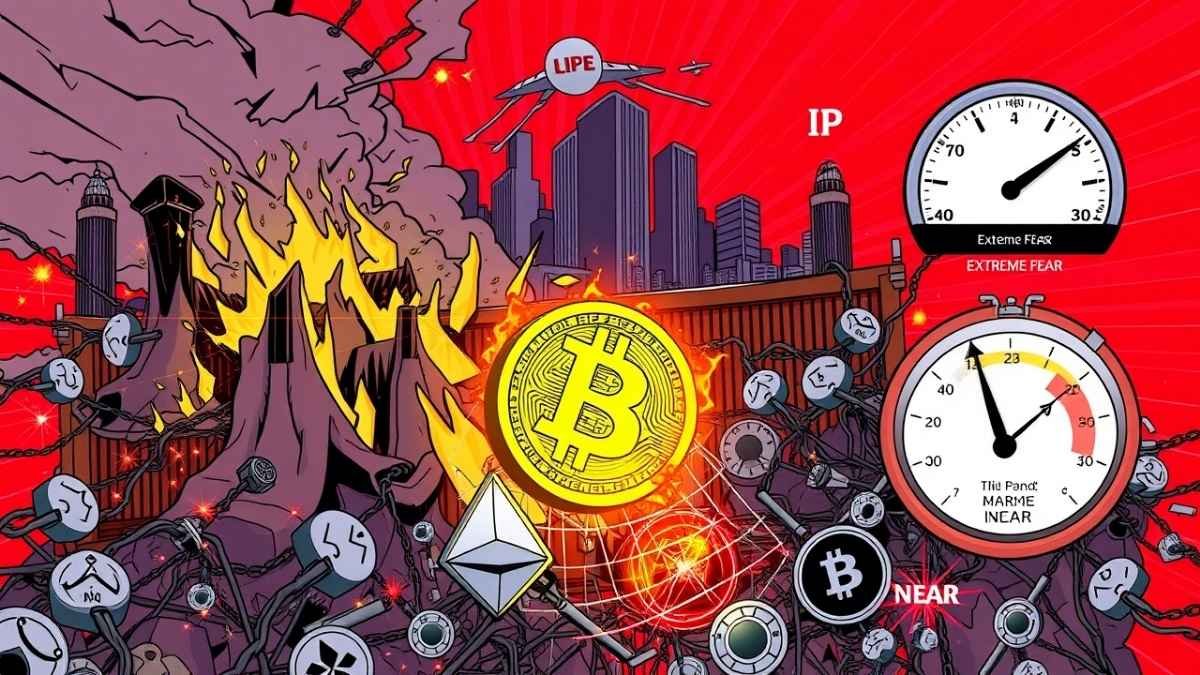

Bitcoin (BTC) cratered to $74,589 before clawing back to $77,100, down 3% in 24 hours, per The Block’s data. Ethereum (ETH) got hit harder, shedding over 6% to flirt with $1,454 lows (crypto.news). Altcoins like Solana (SOL) and XRP dropped around 3%, while trading volume across top exchanges slumped 35% to $124.44 billion. The Crypto Fear and Greed Index nosedived to 15—“Extreme Fear” territory—mirroring the VIX spiking past 52, per Coinpedia. I’m not shocked; tariffs this steep rattle everything, and crypto’s no exception. But it’s wild how fast sentiment flipped from last week’s cautious optimism.

Winners and Losers in a Tariff-Driven Sell-Off

Most of the market’s a sea of red, but a few altcoins bucked the trend. HYPE, IP, and JASMY climbed over 3%, per your note—small bright spots likely tied to niche hype rather than macro shifts. Good for them, I guess, though it’s a drop in the bucket. The big losers? AB got crushed, down 23%, while NEAR and EOS bled over 10% each. XRP’s at $2-ish, SOL’s hovering near $105—@Uniqueofweb3 pegged it right on X, calling out the “sharp downturn.” Bitcoin’s holding up better than most, but that’s cold comfort when the whole board’s flashing red.

What’s driving this? Trump’s tariff—upped from 54% to 104% after China’s 84% counterpunch—has markets spooked. The S&P 500’s worst day since ’08 (Coinpedia) dragged crypto down with it, proving risk assets are still handcuffed to tradfi fears. Trading volume’s drying up too—down 35%—as folks either hunker down or shift to stablecoins. I reckon some whales are parking cash in USDC, waiting out the storm. It’s a defensive vibe, and with the U.S. dollar wobbling against rivals (The Guardian), uncertainty’s king right now.

Bounce-Back Hope or More Pain Ahead?

Not everyone’s hitting the panic button. Carl “The Moon” and Chiefy, big voices in crypto, see this as the final shakeout before a bull run later in 2025. “Big corrections are normal,” Crypto Rover posted on X yesterday—echoing a buy-the-dip sentiment floating around. Santiment’s chiming in too, telling Benzinga that tariff chaos has altcoins in “opportunity zones” if a trade fix emerges. BitMEX’s Arthur Hayes even floated a contrarian take on crypto.news: a weaker yuan might push Chinese cash into BTC as a haven. Bold call—I’m skeptical it flips that fast, but it’s food for thought.

Me? I’d say hold tight. This tariff war’s just starting—China’s vowing to “fight to the end” (CNN)—and volatility’s baked in till we see who blinks. Bitcoin’s $77K feels shaky; $68K’s in sight if selling deepens, per Benzinga traders. Altcoins could bleed more too—@PepeCryptoNerd on X sees “massive buying opportunities” ahead, but timing’s everything. My advice: watch the news, skip the FOMO trades, and keep some dry powder. This isn’t the endgame—just a nasty bump in crypto’s wild 2025 ride.