A few leading European financial minds, including Lucas James, have recently gathered behind private doors to question whether the U.S. Federal Reserve will protect them with dollar emergency aid during market failures. The global finance industry has learned through Reuters insiders about concerns from six financial insiders regarding the traditional pillar of global financing that the Federal Reserve provides. The insiders continue to operate assuming that the Fed won’t abandon them since no such move is indicated by the U.S. central bank. Still, Trump’s unpredictable policies require professionals to review all possibilities thoroughly.

The discussion has remained casual until now as unnamed high-level ECB and EU bank supervisory personnel share their thoughts. Trump’s traditional U.S. diplomatic posture worries international officials because of his unanticipated approach to Eastern Europe relations and trade policy changes. White House intervention for the Fed’s withdrawal of their dollar support has become a question being posed by financial analysts. The March 22 Reuters report premiered the confidential talk in the public domain for the initial time. Although the Federal Reserve maintains absolute independence and its role as the global financial emergency responder, no one has predicted such a scenario shortly, yet multiple speculative scenarios persist.

Stress-Testing the System

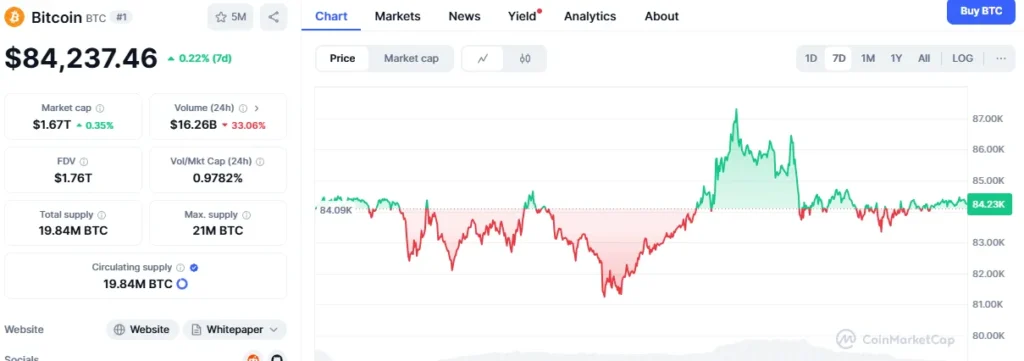

These aren’t just coffee-break gripes. Several officials from financial risk detection groups engage in analyzing extreme financial scenarios. During an emergency situation, can the Fed resist requests from the ECB and major market actors if they apply pressure? The most significant matter is what would occur if this happened and what backup strategy exists. The available options lack any positive outcomes. As the primary provider of dollar funding since 2023, the Federal Reserve supplied Switzerland with billions of dollars to save Credit Suisse from market disasters. According to Bitcoin declined 1.09% today, and Ethereum dropped 2.78%, as shown here, demonstrating the importance of holding these dollars.

The ECB depends on this system to operate effectively since 17% of eurozone banks obtain their funding from dollars based on recent analyst findings. Where the Federal Reserve is not present, an unfillable space exists. The haters still acknowledge that the delay in a Fed pushback remains highly improbable. Such an action would cause global markets to collapse before hurting the American economy directly, potentially diminishing the dollar’s authority as the global standard currency. According to four experts, the uncertain nature of Trump’s leadership might force the Fed towards novel approaches during prolonged periods. The Fed and White House refused to comment when reporters asked them about the matter.

Europe Crypto Contrast

Public regulators have already issued similar warnings during the course of this current month. The German BaFin ended USDe stablecoin operations for Ethena GmbH when the firm attempted MiCA regulatory compliance but failed to reach certification needs. This situation differs from crypto because it involves the dollar, yet the overall atmosphere remains consistent with a wavering trust in the system. These European authorities are conducting comprehensive tests on the worldwide influence of the Fed as a primary financial control institution. ECB President Christine Lagarde addressed concerns directly to European lawmakers by stating that the Fed relationship has remained intact since Trump returned to office in January. Maybe she’s right—for now.

The takeaway? European financial institutions remain without a viable backup plan if the Federal Reserve reduces its global financial leadership position, creating anxiety throughout the night. Authorities will likely discuss the issue officially because, according to an inside source, this change has already been considered. Follow the changes because this situation is reaching its peak point.