South Korean young investors are experiencing a significant market transition on April 13th of 2025. Local stock market participation receives decreasing interest from investors who direct their investments toward US and cryptocurrency markets. New investors focus their investment funds towards US stocks, together with cryptocurrencies. The Korea Securities Depository documents that young investors have substantially ceased their participation. This trend is raising eyebrows. The existing trend represents a concerning financial outlook for South Korea. South Korean youth seem to be shifting their investments away from what? Let’s dive into the details.

Young Investors Are Leaving the KOSPI Behind

Young people in South Korea are deserting the local stock market system known as KOSPI. Results obtained from the Korea Securities Depository demonstrate a noticeable decrease pattern. The domestic market sees 9.8% investor involvement from people in their 20s, while the numbers have decreased from 14.9% since 2021. This is down from 14.9% in 2021. According to Korea Securities Depository data, the population of investors aged 30 years declined from 20.7% to 18.8%. Local stock control now rests with investors aged 50 or older since they make up 71% of the total ownership.

This shift is striking. Several years back, young individuals actively participated in the KOSPI market. They treated this investment opportunity as an instrument for growing their personal financial assets. A large number of individuals now perceive stock market investments to be time-unworthy. Thirty-year-old Park Min-soo expressed his opinion about stocks as a worker. The young worker declared he has never invested his assets in the KOSPI stock market. “It doesn’t seem profitable.” Most young investors hold this identical opinion about KOSPI ownership.

Statistical data provides unambiguous evidence about the situation. The percentage of stock ownership for the 30-something age group decreased substantially from 9.9 percent in 2020 to 7 percent in 2024. The percentage of twenty-year-olds who owned KOSPI shares decreased from 2.2% to 1.6%. People aged forty express modest decreases in their investment activities. The aging demographic of investors has taken over market control to such an extent that it has left the market behind. Market experts warn that such trends create harmful effects for both energy levels and market expansion potential.

US Stocks Are a Big Draw

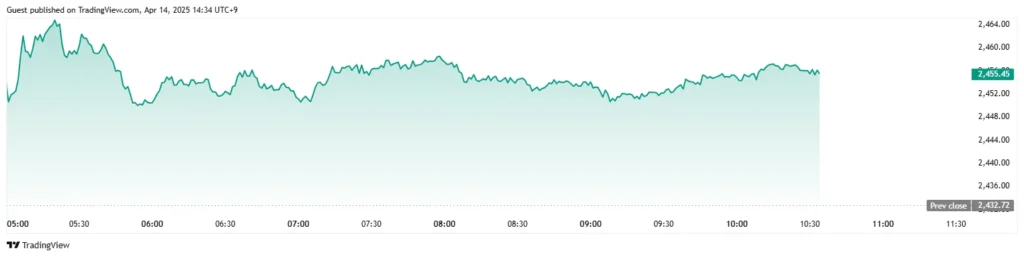

Young investors currently choose to invest in US stocks instead of other options. The majority of investors choose to place their money in stocks registered in the United States, so many South Korean youth find the US market irresistibly attractive. The Nasdaq Composite stock index has demonstrated robust improvement within the United States stock market. From 2023 to 2024, the stock index increased by 50% before continuing upward by another 25%. Such financial performances cannot be dismissed.

The KOSPI shows ongoing difficulty compared to its performance against the US market. China’s market performance fell 10% during 2024 to become one of Asia’s most underperforming markets. The significant difference in performance has significantly contributed to this alteration in preferences. Out of all Korean investors who dealt with US stocks during 2023 72% recorded positive returns. The domestic stock market performed poorly compared to US stocks since domestic investors achieved financial success in just 48% of their investments.

Youths in Korea strongly prefer investing in Tesla stock. The November market figures showed Tesla shareholders possessed $16.7 billion of company stock. Occasionally, investors choose Nvidia, Apple, and Microsoft as their popular picks. Local investors maintained $101.4 billion in US stocks, according to the Korea Securities Depository when reporting in late 2024. The number of investors who purchased US stocks rose substantially by 64% since 2023.

This phenomenon has gained a popular name called “eoljookmi.” People demonstrate faith in the US markets without visible sight. Many young investors show faith in the US markets regardless of danger because they believe they will achieve higher profits. Workman Heo In-sung at age thirty shared his investment rationale. He was developing investments in United States stock markets. I no longer feel attracted to the Korean companies such as Samsung.

Cryptocurrencies Are Stealing the Show

The United States stock market is more appealing than other alternatives. Young investors are moving away from the KOSPI through their interest in cryptocurrencies. Bitcoin stands out because of its revolutionary impact on the market. Its value soared 160% in 2024, reaching $108,249. Standard stock investments rarely deliver such high returns to investors.

The Financial Services Commission documented rising cryptocurrency trading figures. The population segment of young South Korean investors between 20 and 30 accounts for 48.7% of crypto investors within the country. The trading activities on the top five cryptocurrency exchange platforms reached 2.52 quadrillion won in the previous year. The trading volume associated with the KOSPI has reached almost 80% because of crypto assets. A brokerage insider confirmed that cryptocurrency has been draining investment money from stock trading.

Young investors consider cryptocurrency as a way to obtain immediate financial riches through its tempting rates of return. The volatility is high but investors have a chance to obtain substantial financial gains. A great number of investors believe the KOSPI lacks sufficient competitive strength in modern markets. Older investors have joined during the crypto boom yet the youth take the primary role as crypto’s main supporters. More than 700,000 South Korean investors currently participate in foreign crypto market operations. Most of them are under 40.

Problems with the Korean Market

The KOSPI does not satisfy the expectations of young stock market participants. The performance element exists, yet additional components play equal roles in this assessment. The South Korean stock market contains structural problems that impact its operational ability. The major concern within the market derives from inadequate dividend distributions. The dividend distribution by South Korean corporations reaches only 27% of total profits. The 16 major economies report this measurement as their minimum statistic.

Dividends matter to investors. Investors utilize stock dividends as their main source of constant income. Profits generated by Korean firms primarily stay within company boundaries. Because of this situation, shareholders’ dissatisfaction grows particularly strong among younger investors. Investors are interested principally in dependable returns on their investments.

Corporate governance is another issue. The management power of numerous Korean companies rests with influential family groups whom locals call chaebols. In these situations, family control groups prefer to act according to their family needs rather than shareholder requirements. Business practices without fairness become common under such circumstances, and the market becomes less clear when such practices occur.

Asianfinance.com frequently mentions the Korea Discount phenomenon. Stock values of Korean companies are persistently lower than those of comparable international businesses. The Korean political situation with North Korea further increases market instability. The effects of Chinese influence over South Korean economic operations also prevent growth. Multiple elements contribute to making the KOSPI adoption less desirable.

Calls for Reform and Future Concerns

Investment industry changes have raised numerous discussions among specialists. Experts express concern about the KOSPI’s defensive position ahead. Researcher Hwang Se-Yoon of the Korea Capital Market Institute issued a warning alert to the market. According to her prediction, the KOSPI trading volume risks permanent decline. Less trading means less liquidity. This development could potentially threaten market wellness.

Trading activity has declined daily. Less investment appeared during 2024, as the total volume slid from 23 trillion won ($16 billion) at the beginning of the year to 18 trillion won by the end of the year. The market evidence reveals declining momentum in its operation. Young investors play a vital role in sustaining market recovery since they are currently absent from participation.

The government presents initiatives to support the market. The “Corporate Value-up Programme” began operations in February 2024. The authorities wanted to increase popular demand for the KOSPI index. The initiative involved government initiatives to enhance governance while raising shareholder value. The fulfillment of the plan did not achieve its intended objectives. Most young investors and other market participants fail to show any interest in the stock market.

Establishing stricter listing requirements represents an additional move toward improving the situation. Regions’ new set of tough requirements emerged to approve stocks in January 2025. The new regulations exist to strengthen market quality. Research indicates the reforms will not deter young investors. Hyundai Motor Securities analyst Roh Geun-chang states that the market requires substantial alterations. On a KOSPI price rise the shareholders may possibly re-enter. But not yet.”

There’s hope, though. There are indications that the market pattern may reverse. Young investors would reconsider investing in Korean firms once those companies demonstrate improved dividend practices and stronger governance structures. The strong appeal of US stock investments, together with cryptocurrency assets, keeps investors away from local markets for now.

A Generational Shift with Big Impacts

Youth investors throughout South Korea have established new principles for financial management. They actively pursue better investment returns and fresh chances within the market. US stocks offer growth, and cryptocurrencies promise excitement. Meanwhile, the KOSPI feels stuck in the past.

The alterations extend beyond monetary changes. It’s about trust. The next generation of Koreans shows decreasing trust in their domestic market. Young Koreans dismiss their domestic market because they believe it represents outdated and unethical practices. Young Koreans demonstrate their desire to invest beyond traditional borders by using “eoljookmi.”

But the trend has risks. US markets can be volatile, and crypto is even riskier. The collapse of crypto assets, along with stock market crashes, would bring substantial financial losses to novice investors. The potential risks do not stop them from making their bets. These investors consider the KOSPI stock exchange not worth pursuing.

South Korea’s stock market is pivotal in its future development. As long as younger investors do not invest in the market, the financial sector might stagnate. The market requires reforms that will draw back the lost investors. To attract young investors, South Korea needs to improve dividend distributions while strengthening governance standards and raising performance results. Throughout this time, the youth population continues to place their bets between Wall Street and Bitcoin markets.

The economic structure of South Korea might experience fundamental changes through this active rebellion of new generation investors. The situation is a critical alert to business organizations and monitoring institutions. The KOSPI requires evolution to ensure its survival in the market. The current voting with money occurs as young people select United States assets and cryptocurrency rather than domestic investments.